I've been an Apple Watch wearer for years but I have recently gotten rid of it. Why? I was tired of the amount of noise it brought. When the phone rang, everything in my office rang. It was overwhelming. It was noisy and it put me in a temporary state of paralysis.

All that input made me feel like I was being pulled in four different directions, instead of being alerted to simply... answer the phone.

What has this got to do with data in finance? For CFOs, the overwhelming amount of data that's available can sometimes feel a little like this.

The more information we have access to, the more prominent information overload and decision fatigue are becoming in business. There's a lot of noise - everything's connected and you can really get bogged down in the weeds instead of, you know, simply answering the phone.

This is why I'm always telling the CFOs I work with how important it is to make sure their data is working for them - and not the other way around.

We love data, right?

There's no arguing that the availability and accessibility of data can solve a lot of problems. The ability to analyse numbers more efficiently has not only made us better CFOs but it's also made our job more interesting.

Because data is objective, it can galvanise people, it can be the thing we rally around. Lots of good can be done with data when it's treated in the right way.

It allows us to really go deep and take our understanding of the business and triangulate that with our financial acumen. It helps us make decisions that drive measurable value in our businesses.

It can open our eyes to opportunities and create insights. It can send us in the right direction on the right track.

Data is great. But, of course, there's a flipside.

Data can be dangerous if not used correctly

The abundance of information that we have today can put CFOs in a dangerous spot. If you just willy-nilly dive into the data instead of opening up your eyes to see patterns, trends and opportunities - suddenly there can be problems. And you can end up in a negative and overwhelming loop.

It's hard to see the right path when you're being pulled in different directions. This is the definition of analysis paralysis. And this is why we have to be so careful with our data input.

The more numbers and more inputs we have, the more information overload and decision fatigue we're likely to experience.

There's just so much noise.

Although that's enough alone, it's not the only reason we need to be careful with data.

I talk quite a bit about why as a CFO coach I stress the importance of social skills. Social skills allow us to leverage the analytical abilities of those around us. They help us to connect with and strengthen our team.

Data delivered incorrectly can do the opposite, it can destroy conversations. We've probably all been in a meeting where a very well-meaning accountant is telling the numbers.

Performance is down. Revenue's down, the numbers are in. It's not very uplifting.

Being a CFO is a people job. We can't afford to get bogged down in the data without being discerning. It can destroy morale and relationships.

This is why it's so important as CFOs to make sure the data is working for us, and not the other way around.

We need to do data intentionally

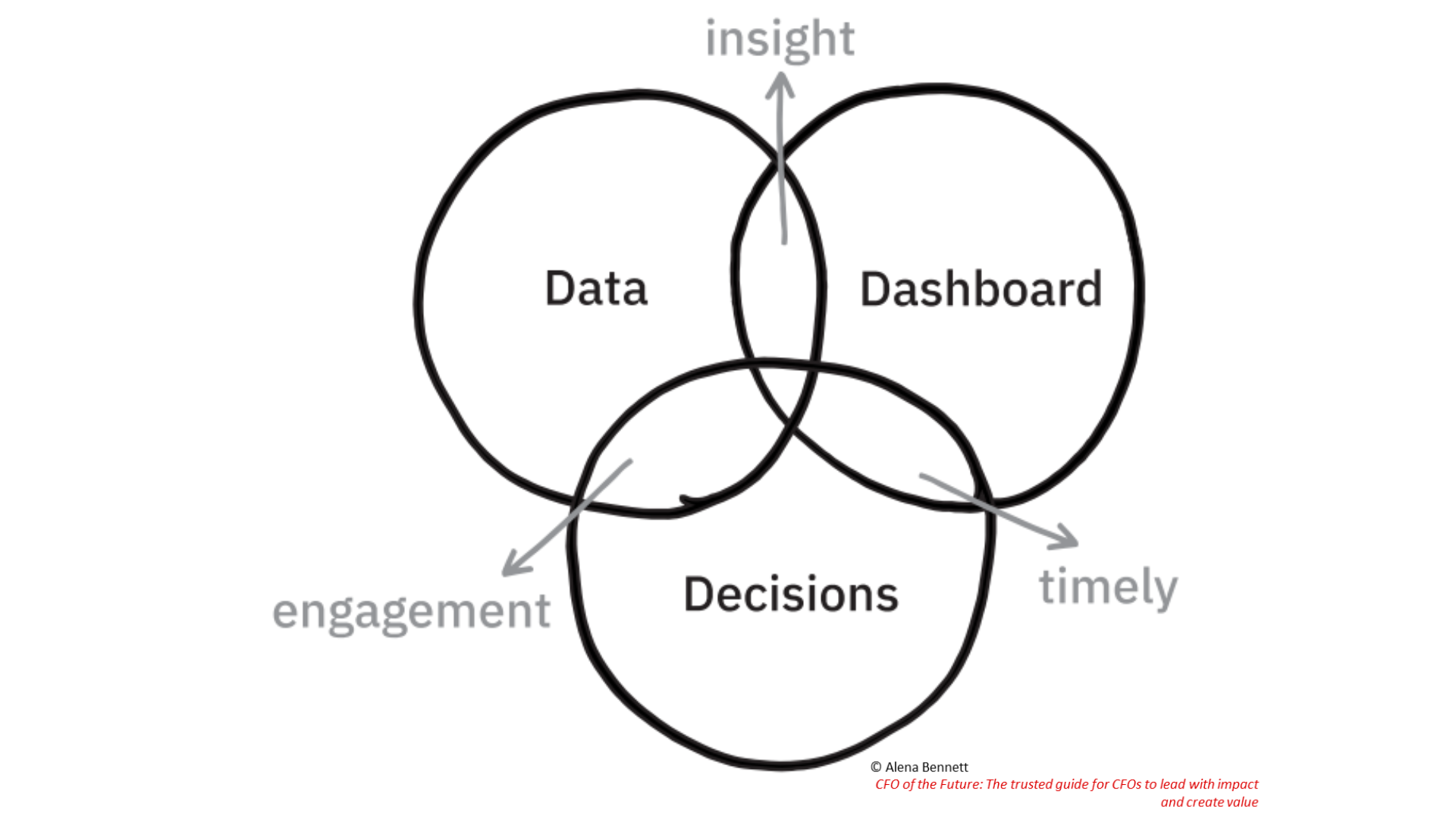

Now I have explained why we need to be discerning with data. But how? The answer is; we need to do data intentionally.

Rather than letting the data lead the way, ask yourself; what data do I need to support me in my pursuit to create value?

• Know what decisions you need to make.

• Know what conversations you need to have.

• Know what the stakeholder's views are.

• Know the key levers of performance.

• Know your personal brand statement.

Once you have your intentions set, then go ahead and access and analyse the data you need.

Just like I tell my kids when I take them to the candy shop - you don't need it all.

It's all about balance

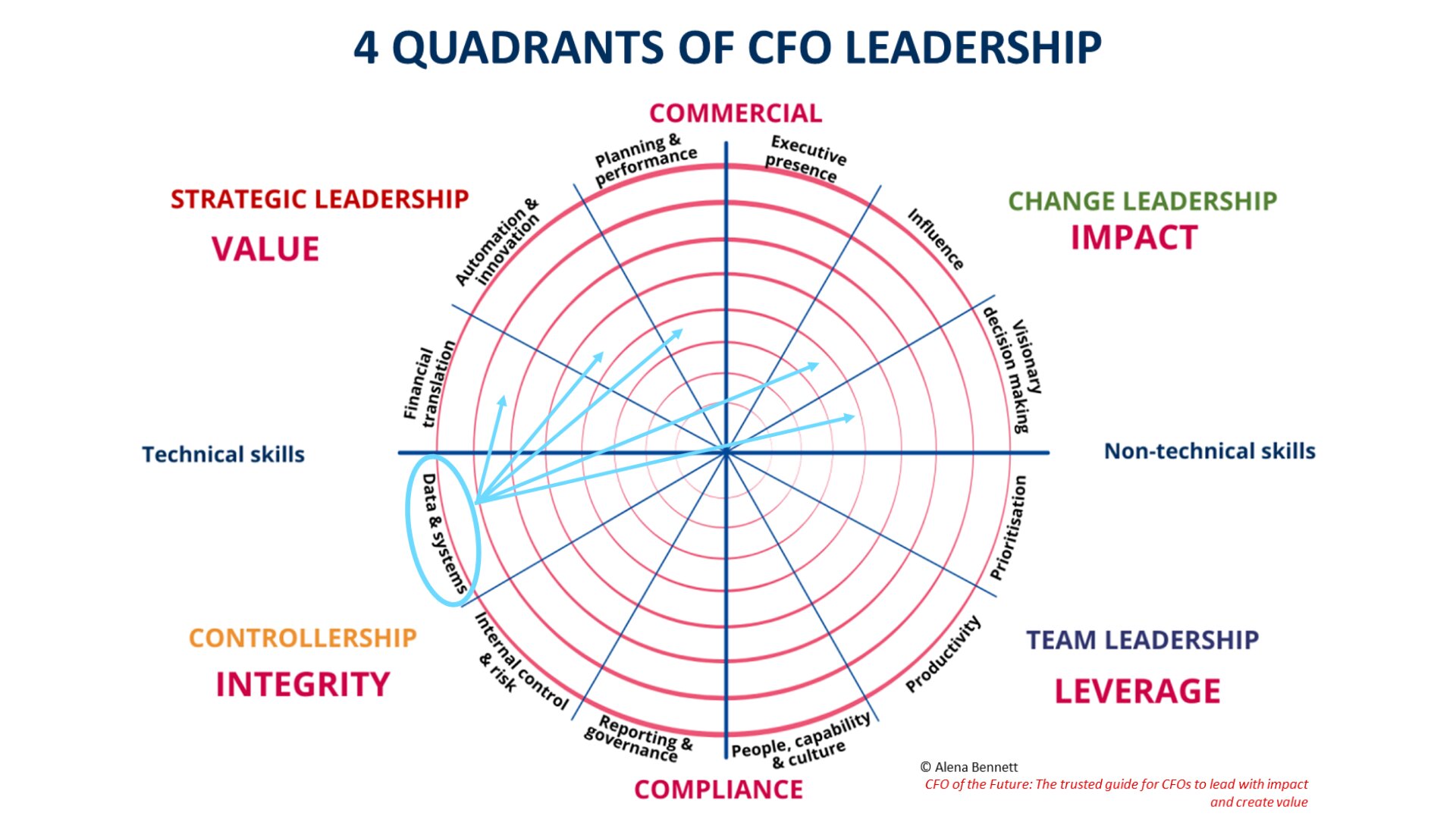

What is the difference between CFOs and our accountants? Is it our years of experience? Our expertise? Possibly our education? I'd argue that it's our ability to process a range of information to make strategic-based decisions, not ones purely driven by data.

Sure, we want to have a data-driven mindset, but we need to make sure our CFO mindset sits above it.

What's the most important decision you need to make at the moment?

Are you being discerning with your data?

How do you use data to tell the story?