End of financial year is a CFO's Grand Final.

To mix metaphors, it's when everything comes together and the CFO becomes the conductor of the orchestra comprised of the leaders and teams across their organisation that contribute to the preparation of the end of financial year close process, accounts, tax returns, Board papers, APRA returns, audit and...well, you get my drift.

Most end of financial year processes are accompanied by a detailed year-end process. With the competing priorities, number of meetings, reviews, sign-offs, coupled with the opening of the new financial year books and month-end can make for a complex - and often chaotic - period.

This is where the simplicity and clarity of your 5 Pillars of High Performance CFOs can help. Here are 3 simple, impact and actionable tips within each Pillar of High Performance:

1. Professional:

• If you need to enter into a high stakes conversation, take up journaling. Journaling clears your mind by helping you unpack your thoughts and let go of any unhelpful baggage you may unintentionally bring into the conversation.

• Surround yourself with a support network that lifts you and will be your 'phone a friend'. A great community of like-minded peers can provide you with invaluable perspective to help you solve your biggest problems, because you know what? They've probably experienced the problem for themselves!

• Give yourself the space for discomfort and growth so you finish year-end smarter than you started. You should feel tired, but not depleted at the end of the process. (Prioritise your Personal pillar of high performance - see below.)

2. Financial/Technical:

• Start with the outcome in mind. Remember - an outcome can be qualitative. This will help you avoid tinkering with the last 5% that doesn't contribute materially to the outcome.

• Be clear on your materiality thresholds - you'll save a huge amount of time and angst here.

• Remember everything will get done, it always does. Prioritise the areas of judgment to avoid them dragging to the death. Make sure your energy and effort are in the high impact areas - this is your greatest value as the CFO.

3. Structural

• Ensure you set up your workspace in the optimal work environment. Remove friction and distraction so you're free to move, think and talk.

• Do your highest ROI work at your best times - know your energy flows, optimise your calendar and protect your time ruthlessly!

• Make sure your communication cadences and channels (including escalation) are fit-for-purpose. Your 'Do not disturb' in Microsoft Teams is there for a reason!

4. Cultural

• Ask your team how they want to be recognised for their achievements along the way. You'll be surprised how little they need and it goes a long way.

• Remember to thank your team at the end of the day. Again, it's the little things that count.

• Take the time to check in quickly with team members working remotely or in different timezones. Year-end can be incredibly isolating.

5. Personal

• Eat well. It's the fuel for your body and brain.

• Get enough quality sleep. Your brain solves your biggest problems when it's resting, so if you don't sleep, you simply won't perform.

• Move your body. A strong body is a strong mind.

CFOs need to not only be a safe pair of hands for their organisation, but the smartest thinkers. Year-end is your time to shine.

Download the 'CFO High Performance Habits checklist' here if you want more ideas!

See you next 'year'!

In the name of quality and client service, it would have been very easy for Conor to adopt the 'work longer and harder' mindset. Having dinner brought in for 'the night shift' was common for audit teams back then as the Sarbanes-Oxley requirements were still relatively new and auditing standards and documentation requirements were increasing.

However, that wasn't Conor's nature. He wanted to get the job done, and enjoy doing it.

1. Let go vs micro-manage

The first thing that Conor enabled for me and the team was the freedom to complete the work in a way that worked for us.

For our team, in order to meet the SEC reporting deadlines we needed to work around the clock....but not 24 hours a day. So the team and I agreed they would do the work during the day and deliver me the binder (this was before we worked completely electronically) at 6 or 7pm for me to start my working day. I would spend the day at home doing the things I wanted to do, whether that be work out, do errands or simply relax. Then at night, it was 'game on' for me.

It might have seemed unthinkable to some partners that during the peak reporting seasons a Senior Manager wouldn't be working around the clock, but Conor believed that the team could organise itself around the tight deadlines. He was right.

2. Disrupted the chain of command

During my 2+ years on that particular client, the Concurring Review Partner (CRP) changed. If you're not familiar with it, the role of the CRP was to review the most critical and judgmental parts of the file to ensure the team had sufficient appropriate audit evidence to support the findings and conclusions it had made.

With a new partner came new questions and expectations...without any changing of reporting requirements or deadlines. In fact, it was about this time that it felt like reporting requirements got stricter and deadlines became tighter. Having invested the past few years making our process as schmick (and that's a technical term!) and friction-free as possible, something had to give.

Conor broke the process. 'Why don't we get everyone together on the first morning of the quarterly review – everyone from the CFO and audit CRP to the junior accountant and audit intern – and perform the analytical review together?', he suggested. 'We spend as much time as we need together to perform our required audit review procedures, clear any questions and queries that we have about the numbers, so that by the time we walk out of the room, the engagement is largely done, but for some documentation.'

This was genius. In making this suggestion, Conor:

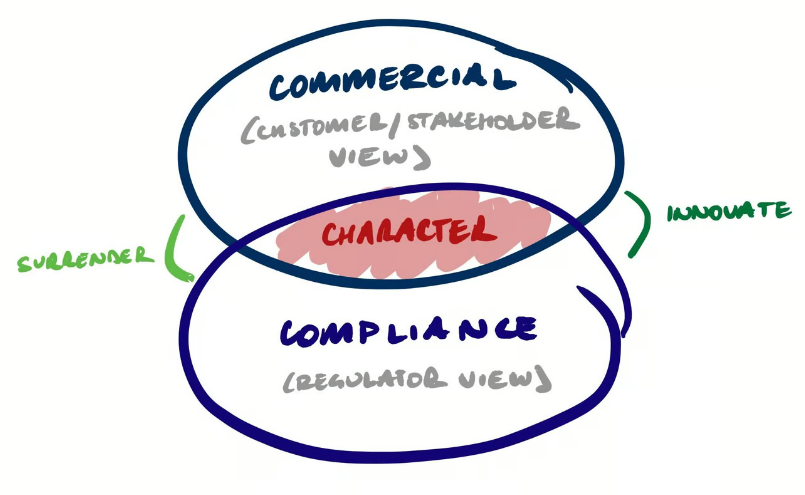

• Demonstrated his character and challenged convention. Not one for flexing his status or ego, he levelled the playing field by removing the hierarchy that is built into the both the audit review process and the finance team. In doing this, he elevated the responsibility and accountability for everyone to be present and bring their 'A-game' to that meeting. He also challenged the status quo and did things differently.

• Stayed true to his compliance responsibilities – it would have been tempting for him to influence the new concurring review partner to 'trust him' and to push the team harder to meet the crazy deadlines. But he didn't. He suggested a practical process that allowed each person to discharge their responsibilities fully, without compromise.

• Created a commercial solution – as I mentioned above, this audit client had extremely high standards which they held themselves and their service providers (including us) to account. Conor knew that as auditors we needed to step up to those standards and not be the factor that slowed things down. This new approach to our audits demonstrated our commitment to being commercial without compromising our compliance role.

Conor could have easily just kept us doing the way things had been done before, just working harder and faster, and through the night. His 'commercial' solution could have been to simply get his audit team working through the night so as not to disrupt or disturb the client all in the name of service. But he didn't.

He surrendered to the dogma that compliance and commercial responsibilities are mutually exclusive. By detaching from this perception he was able to consider what else might be possible in that pressure cooker scenario. And in doing so he innovated the generally accepted way of doing things. Not only that, he demonstrated his commitment to the team such that we would walk on water for him when the circumstance required it.

Consistency is critical

This is not an 'all roses' story. I cancelled trips to both Switzerland and Niagara Falls to meet other client deadlines that Conor and I worked together to meet. To this day I still have not taken those trips and they are 'the ones that got away'.

But do I begrudge Conor for that? Absolutely not. A great leader creates an environment that allows you to make empowered choices... even during crunch times.