The number of 'The Greats' arising out of the COVID-19 pandemic is starting to feel as pervasive as the number of 'Big' things around the Australian countryside ;-) We had the Great Resignation, the Great Migration and the Great Pause.

I think there's one phenomenon that's a slow burn and that will only present itself over the next few years and that's the Great Identity Crisis. This has the potential to exacerbate the talent crunch that CFOs and their organisations are already experiencing, therefore adding to the pressure of an already increasing remit.

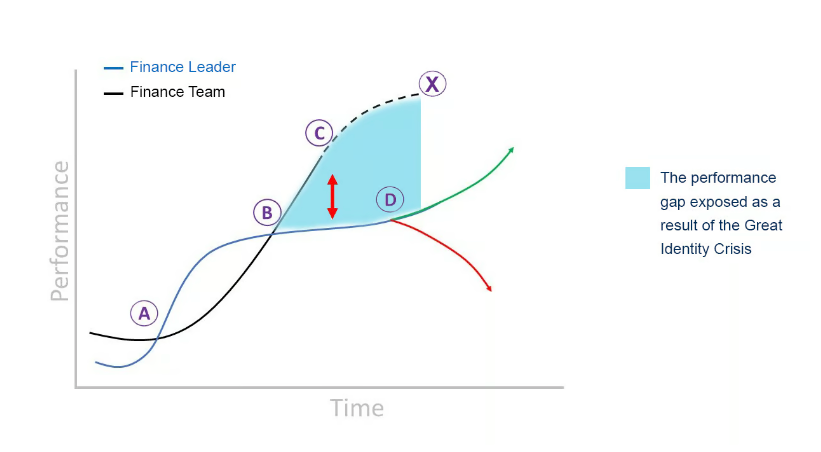

Consider the diagram below which shows the performance trajectory of (1) finance leaders and (2) the finance team as a whole over time.

For now, imagine the blue line represents the person in your finance leadership team (FLT) who has the most impact and influence over finance delivering its strategy - they may be your 2IC, or they may not be. At the time of their hiring, they come in and learn the ropes, and at point A, they hit their straps and start to fly. They really find their feet in your organisation and are optimistic about what's possible. They start having an impact, developing their team and creating value.

You identify them as high potential, maybe even already high performing. As the boss, you're high-fiving yourself at this exceptional hire. What you don't realise is that your team leader's high level of engagement is deeply attached to what they do and the outcomes they deliver. This is the start of them building your finance team into their identity. They're building strategy, delivering strategy and influencing growth.

Over time this trajectory slows down a bit at point B. This is where those feelings of 'What else is there?' come into your team member's psyche. They've been around long enough to move from 'What's possible' to 'What is'. They've become realists, and maybe even cynics or pessimists. This starts slowly at first, then permeates the mind and body creating a period of stagnation. Wallowing and stagnation plant seeds of doubt and disengagement and turn slowly to mediocrity.

This continues until point D, which is the tipping point. At that moment, the executive can't take anymore and asks, 'What am I doing?' 'What am I doing here?' And 'Is there somewhere else I should be?'

At tipping point D, your leader has a choice. They can lean into their frustrations and confront the discomfort. Understand what it is telling them and connect the dots to their commitment and performance on the job. This is about taking responsibility and accepting the challenge to be a true leader of the finance team. They can take on the identity of a catalyst of performance growth and do the work that takes them on an upward trajectory - they take the green line. This is for themselves and for your finance team. It puts your finance team on the path to becoming the finance team of the future.

If your leader doesn't choose that path, they hand their performance over to the power of time. We know that time compounds all results, and when we don't act with intention, we drift. When we drift we go with the flow and end up in a place we don't want. Down on the red line.

Now let's add the finance team overlay

The whole finance team's performance journey is the black line. We see that the performance trajectory at the beginning has a slight lag effect. This accounts for the fact it takes a little extra time for the impact of your leader's (blue line) performance growth to be felt and seen in your team's performance metrics. Once that kicks in, the trajectory lifts and growth is established. Team performance feels comfortable and as the CFO, you're optimistic.

That said, team performance continues to grow even after your leader starts feeling pangs of uncertainty. This is the line between points B and C. Your team is running on the momentum of their work and the processes and innovations they've implemented. But be warned: processes need to be managed and innovation needs to be cultivated and nurtured. This period is risky for you and your team because it's running on autopilot. No one is taking control. Your leader is starting their deep identity work, which creates an 'executive detachment delta' which represents an opportunity cost for you as the CFO of not knowing that your leader is starting to disengage and therefore not taking remedial action with the team member involved.

At point C, the CFO team's risk profile increases to moderate. Over time this risk increases as the impact of your 2IC not performing at their best is increasingly evident in your team's delivery of outcomes.

Here's a scary throught: at this stage no one knows this risk exists. (If other leaders of your FLT know, they're not at a stage of their own journeys where they're happy to share.)

As the CFO, you're running blind.

After point C, the risk profile increases until the tipping point at 'X' where one of two things happens.

1. Either the CFO notices the leader has run adrift and takes action

2. Or the executive has had enough and decides to take action

At this stage, you can see the potential performance gap is quite significant - and that is just indicative of 1 of your leader's going through their individual identity crisis. Now consider that most members of your FLT are going through their own identity journey - do you know where they are on the blue line?

If you suspect they are between point B and point D you need to take action immediately.

Why the urgency: From the great resignation back to the rat race

During the COVID-19 pandemic, Australia saw some demographic shifts that proved Australians had started to find answers to this question and were taking action.

I hoped that the impetus created by the pandemic would create a permanent and empowered shift in the way people saw their careers and livelihood. However, I'm sad to say that now, in 2023, most of us have fallen back into our old ways.

2022 saw businesses return to the office and kick-start their growth plans, trying to make up for two years of lost time. A sense of urgency and frenetic activity became part of organisations' DNA while they tried to manage the new hybrid way of working. It created almost a bipolar culture – where, on the one hand, we care for our people, making sure they're OK, yet at the same time, we ask more of them than ever in any given work day or week.

We can't have another year like 2022. It's unsustainable. And the tension will lead to our finance team members continuing to ask 'Is this all there is?' and 'Is it worth it?'.

We are approaching the Great Identity Crisis — and we don't even know it.