One of the best things we brought with us when we returned from the US almost 20 years ago was a little jar for making salad dressing. It is very simple – a glass jar with a plastic stopper, and it has line markers on the outside: one for the dressing seasoning, one for the oil, and one for the red wine vinegar. When these ingredients are filled to the respective lines and shaken together it makes the most delicious dressing that works beautifully on any green salad.

But only if this combination is made in accordance with the measurements on the side of the jar and only when it's shaken and mixed together.

Finance teams are exceptional under pressure

Many finance teams would describe the last few years as a period where they have been well and truly tossed, shaken, and stirred through the corporate salad. And it's worked. In times of crisis and during 'crunch times', what CFOs and their Finance teams are really good at doing is pulling together and getting the work done and delivering the result.

Few functions are as reliable in delivery as the finance function. It's why organisations are looking to finance to take care of ESG – not because there are commonalities in the technical capability required but because of the complexities in bringing meaningful and reliable ESG reporting to life. It is generally accepted that only finance has the rigour, discipline and reliability to take on or have oversight for such a challenge.

What happens when things settle down

On the other side of this corporate turbulence, what is emerging is a vast gap between the CFO and their team.

I'm not surprised, really. In those crunch time periods, it's definitely a 'divide and conquer' mindset. Just roll up your sleeves and do whatever's needed to get through the work. Hierarchy is momentarily forgotten, and it's the beautiful combination of ingredients in the right proportions that makes the beautiful cohesion of capabilities and strengths across the team.

However, when the things settle and there's no fire to fight, what I've seen emerge is that CFOs have elevated in their ability to take care of the strategic issues, work with the key senior stakeholders to ensure things keep moving, and the team have simply doubled down their efforts in the corporate weeds.

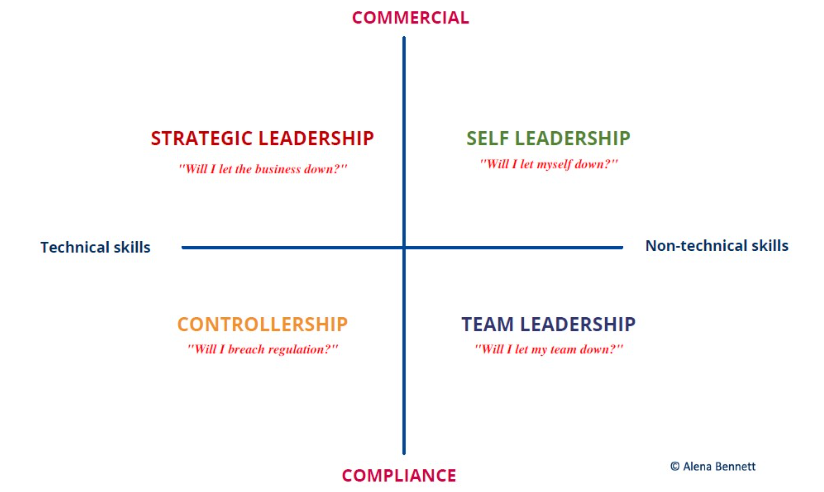

Said in the context of the 4 Quadrants of CFO leadership, CFOs have progressed further (higher) on 'above the line' capabilities and the team have remained proficient 'below the line'. The most obvious gap is there is no one who could easily be your proxy in an executive or Board meeting.

The right recipe

The phrase 'elevating capability' is, while accurate, a blanket statement and therefore not particularly useful because it's not practical.

Getting the right balance of capability in your team is just like getting the perfect combination of oil, vinegar and seasoning to create a delicious dressing to complement and enhance the fresh flavours of your vegetables.

Have you perfected the ingredients in your finance team recipe?

I understand the talent crunch right now, so if you're a little confronted or frustrated by this question, you're not alone.

However, our strongest reactions, thoughts and emotions area useful data points that shouldn't be ignored or dismissed because of external conditions. Those external conditions will change.

Do you have the finance team your organisation needs for the future?

The answer is likely no.

The rate of change is accelerating

In the World Economic Forum Future of Jobs 2023 report, 44% of the workforce core skills will change in the next 5 years.

Just think about that for a moment. Almost 1 in every 2 of your team will require a different set of core skills in 5 years. What does that mean for you?

Take a look at the top 10 skills increasing in importance over the next 4 years:

Add to that, consider the fact that Gartner has predicted that in 3 years, 50% of new hires in finance will have backgrounds other than finance and accounting.

It would seem we're back in that salad dressing jar getting shaken up for an entirely different reason.

The unknown variable

These are important data points for a variety of reasons, but one obvious decision point for CFOs comes to mind. Will you upskill for these changes or will you replace and recruit for the new capability? There is, of course, an unknown variable in this: will your current staff still be around in 3-5 years?

When we do our Catalyst and Ignite planning processes for Chief Financial Officers and their teams, we create a 5 year plan. In that plan we insert intentional career growth and in that process, the CFOs and finance leaders in the room ask themselves 'will my current organisation be able to provide me with the space and opportunity for this growth' and if the answer is 'no', they insert in their plan a transition.

Shining a light on the unknown and unspoken

I think the opportunity is now for CFOs to have honest conversations with their team around their career aspirations and how that may/may not align with your organisation's finance team of the future. I know I'm stating the obvious, but given the rate of change of skills required I think a more upfront conversation needs to happen which likely sounds something like:

"The skills required to achieve Finance objectives are going to change significantly over the next 5 years."

"You'll be required to develop and grow to keep up with the pace of change. We all will."

"I am working through what that might look like, and I will keep you informed along the way. I would love you to support your continued growth."

"Does that align with your career aspirations in that same period of time?"

The structural pillar of high performance

There's no doubt we're going to experience a change in the way finance teams are structured. CFOs will need to be smarter in how they utilise their resources to support the business cross-functionally and create an Office of the CFO that can mobilise resources and implement innovation quickly.

Quite often, the top performing finance teams are well-established units that would be categorised as having the agility of a cruise ship as compared to that of a super-yacht.

CFOs need to maintain the quality whilst increasing the velocity.