Structure can be defined as 'the arrangement of and relations between the parts or elements of something complex'.

We need structure because it acts as a useful short cut for us mere mortals to understand complex concepts. It helps us create meaning around something without having to dig deep and interrogate the issue so as to understand each scenario and all its unique nuacnes. It equips us with a 'shared understanding' of commonly used terms/phrases/concepts.

Our organisational context relies on structure

Let's look at 3 different perspectives of how structure is used to create shortcuts in our organisational context:

1. Our organisation: Keeping it really simple for the purposes of brevity, they're either public, private or a partnership in its structure. Knowing this alone tells us a lot about your organisation.

2. Within your organisation: What departments do you have? Sales and marketing, operations, risk, IT....again, without having to delve any further, most people will know what goes on in those departments without asking too many questions.

3. Your job title within your organisation: Chief Financial Officer, Finance Director....you tell me this, I know a lot about you already.

The downside of corporate structure

However, each of us is unique, as is the way our organisation is structured. It's nuanced, to serve the organisation's purpose and to deliver its intended value. While structure provides us useful shortcuts, it can also result in unhelpful judgments.

What do I mean?

Well, it's quite simple. Every time - maybe 95% of the time - when I meet a CFO for the first time, they will at some point tell me 'they are not the typical CFO'.

Why do they feel the need to tell me this? Because they feel that the title alone evokes a stereotype that they don't completely embody. It doesn't give me the full picture.

Structure puts us in a box - what's really going on

It makes sense to me. By the time you're at the CFO level, you've likely had a successful career that hasn't necessarily been linear or 'typical'. You've also likely collected skillsets that weren't the norm for CFOs back in the day. Most importantly, you've grown as a person over your decades in the workforce and you view the world in a way that's unique to you.

By telling me 'I'm not the typical CFO' what they're really saying is 'Please don't typecast me. I have a unique story and I'd like to explore what might be possible with you.'

What's actually going on is that they're toying with the possibility of getting out of the box they find themselves in and I think that's pretty special.

What happens when we stay inside the box

When we operate within the box, we limit ourselves. We inherently shut down the opportunity to demonstrate curiosity which means we close ourselves off to innovation. In doing that, we feel constrained, suffocated even. It's frustrating, knowing that when you go into the office, you need to shut down the part of you that makes you 'you' so you can conform and play within the box.

It's like trying to fit into a fashion trend when your body shape just doesn't fit. I grew up with Kate Moss as the 'it' girl. Remember her hip bones? I'm Tongan....enough said. It was uncomfortable growing up during that era feeling the pressure to be small.

When we play in the box at work, we keep ourselves small so we fit. That's how structure can hinder you and your team at work.

The upside of structure

However, structure can be incredibly useful for Finance teams. I do a lot of work with Finance and Executive teams to help them improve how they communicate with each other, work as a cohesive unit, and support each other to unlock productivity gains. One of the components that inevitably comes up is their rythms, routines and cadences.

That is, do they use structure well to give the team clarity and ease?

Quite often the answer is no.

Why not?

This can be for the following reasons:

- as an innovative or fast growth company, structure is interpreted as 'hierachy' - otherwise known as the devil.

- their structures are outdated and aren't fit for purpose

- they haven't experienced the positive link between structure and ease

How CFOs and their teams can use structure

Structure doesn't need to be this massive overengineered thing. It can be as simple as a standard agenda for a recurring meeting, heck - it can be putting the recurring meeting into the calendar in the first instance!

There are, of course, levels of structure depending on the purpose for which you need it. Which is exactly the point.

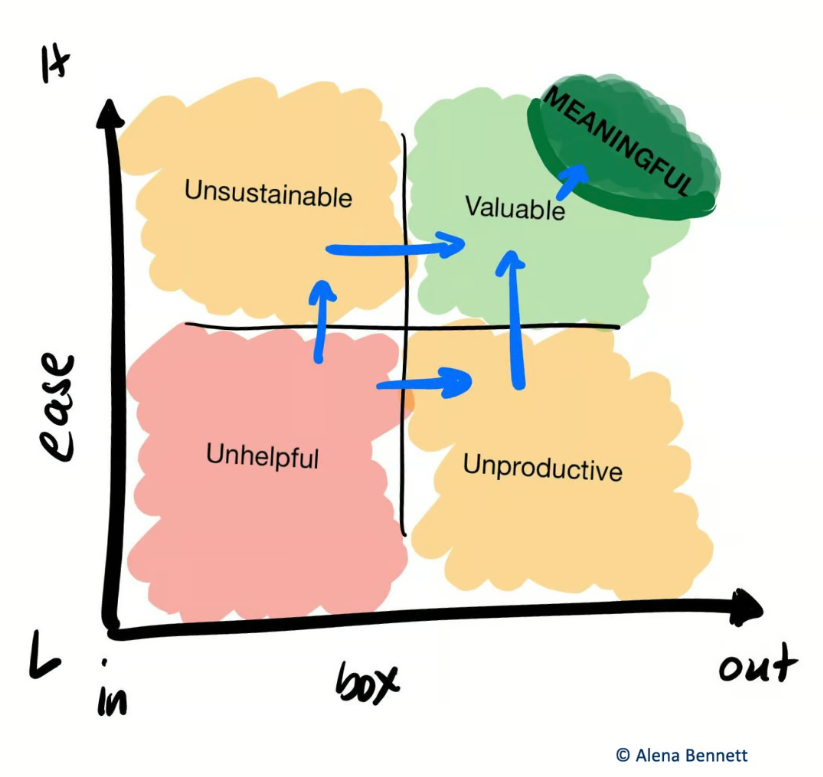

Take the model above:

On the X axis, we have limiting structure of a box. In the box = limited, out of the box = unlimited.

On the Y axis we have strucutre for the purposes of ease: so high structure = high ease, low structure = low ease.

It's really unhelpful if you have little to no structure, yet what you do have restricts people to play in the box.

At the same time, if you have a high level of structure, yet you're still keeping people playing small in their boxes, you have an unsustainable model. Because eventually they wake up to the realisation that they're not playing their own game, and their frustration takes over...resulting in underperformance or turnover.

That said, you don't want to just let people run willy nilly around your office playing solely by their own rules - where's the unity in that? It would be highly unproductive!

Which is why you need to get the nuance right for your organisation and your team so that you unleash the ability for your team to flourish and thrive while at the same time enabling them with structures that create clarity and ease in achievement of the strategic objectives. This is where structure is highly valuable to you and your team.

If you really want to have the best in class (ie top 5%), then that's where you get the structure so right that the team has the ability and authority to lead themselves - where structure becomes meaningful - because you no longer need to play traffic controller. They run themselves, so you can focus on running the business.

Knowing the relationship between structure, retention and ease is critical for CFOs right now.

This is how CFOs foster a team culture that inspires purposeful high performance that delivers meaningful value to their organisations.

It's how you get - and stay - above the line and out of the weeds.

How are you using structure in your finance team?

What is more important to you right now - retention or ease?

How can you elevate staff performance by adjusting the structures embedded into your team?

Love to hear your thoughts...