Did you know that waves come in 'sets'? I recently had a stand-up paddleboard (SUP) lesson where - even though I know how to SUP in flat water, I didn't know how to ride waves. So I booked myself a 1:1 and my teacher spent the first 20 minutes talking about the board, the paddle and the surf.

I have to admit, I was bordering on a little impatience in that initial 20 minutes.

The major 'penny drop' moment was when he talked about 'sets' of waves. That, due to the fact waves come in sets, your job is to find the best time to run into the surf and get over the break...and this time is immediately after the previous set is finished.

I think there's an interesting parallel here between this and how CFOs and their teams plan.

If you don't wait for the right break in the surf, you get into the position where you're stuck pushing you and your board against wave after wave trying to get through. The wave either takes you back to the shore, or you persevere until the next break. Either way, it's exhausting.

Why finance planning fails

1. No downtime. The challenge that CFOs have when it comes to planning is that the idea of planning inherently assumes that the process has stopped and you're planning to start something new. Well...as you well know, as a CFO it very rarely feels like the job is 'finished'. Something is always in train – downtime is limited.

2. There are always things that don't go according to plan. A cyber-attack, unexpected turnover in a key leadership role or people matter that needs to be addressed. This can make it feel like the planning time is wasted.

3. Poor implementation - your team don't follow the plan. After what feels like a deep, strategic planning session, people revert to type and they don't change their activities to achieve the priorities.

These are just 3 reasons, and there are many others. With the ever-present pursuit of productivity for CFOs and their teams, the consequence of this is that planning is always the first part of the process to go. Which means you end up doing task after task, deadline after deadline, and it's non-stop. There's no break.

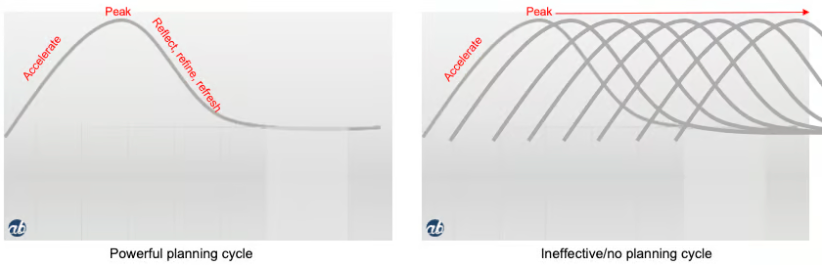

It's interesting - when we work with our clients we break down our quarterly plans into 2. That way we look at 6-8 week periods and in that period, we recognise there's a ramp up and a cool down period. This is represented below on the left hand side.

Now, contrast that to the situation that most finance teams find themselves in and that is without the time or space to plan. That means there is no break and because we aren't ever just working on one thing, your team is constantly in ramp-up or at the peak time - as represented on the right hand side of the image.

What's fascinating about the image below is that the situation on the right (no finance team planning) actually looks like a set of waves crashing one after the other...only to leave the poor surfer (or in my case, SUPer) exhausted. Much like is the case when a finance team can't plan or catch their breath.

Why finance teams need better planning

1. When there is a lack of downtime due to business pressures, planning allows your team to catch their breath. It allows them to draw a line in the sand to say 'tomorrow will be different' and to reset and refresh habits and behaviours that may have dulled like an overused knife. Giving your team the space to plan well not only creates clarity, but injects energy into what might be an otherwise fatigued or uninspired team.

2. Yes, there will always be surprises. But in my years of experience as an external auditor, finance leader and CFO mentor, there are very few. Which means good planning provides you with the space to handle legitimate surprises. Without that space, you and your team rapidly and too easily fall into firefighter mode. So when planning is done well, you reduce noise and surprises so you make better and faster decisions when you need it most – i.e. when things don't go to plan.

3. Your people need positive feedback loops. They need to know that good planning delivers great results and they need to understand the part they play in it. And, most importantly, how it benefits them.

Finance teams need to change the way they plan.

Most CFOs want to develop great strategic plans for their teams. They want them to get strategic so they have the confidence that strategic priorities will be achieved. But a strategic plan is still only in the orange zone because in the orange zone is the there is still a reasonable amount of intervention required by the CFO. The CFO can feel like they're still controlling traffic and without them, decisions wouldn't made, issues not escalated or closed out.

CFOs need to enable teams to develop powerful plans – ones that result in unity across the team but where the focus is visionary, so that it inspires and mobilises the right attitudes and cohesive actions across the team. When this happens, a CFO has the opportunity to not only be hands-off but be open to guiding their peers, CEO and Board with their hands out to offer support and said guidance.

It's time for CFOs to get planning right for their teams

If you're keen to ignite a powerful planning process for your team and know that FY24 is the time to start, then take a look at the Ignite planning for Finance teams.

This is an easy and simple way for you to give your teams the experience of not only clarity of task, but the opportunity for unity of vision which will only deliver accelerated and exponential gains for you for the full year.

Help yourself and your team get a head start to FY24 and elevate finance's contribution to your organisation.

Give yourself the gift of space and take control of the next financial year.

Otherwise it will feel like it's year-end all the time.