Are you familiar the popular saying 'how you do anything is how you do everything'? Well, I think that's right. Especially when it comes to CFOs and how they 'do' year-end.

As you know, 'year-end' (whether that falls on the Australian end of financial year of 30 June or otherwise) is a milestone date for all CFOs and finance professionals alike. It is known for its hard work, tight deadlines and pressure cooker scenarios and decisions.

It's typically a time of year that CFOs pardon themselves for a shift in their behaviour – 'I roll up my sleeves and get stuck in the detail'.

'Yes, I probably am too directive and micro-manage my team a little more but I'm doing it to help us meet our deadlines' and 'sometimes I just take over because it's easier that way'. What they're saying is 'I know this isn't how a CFO 'should' operate but I am choosing - albeit temporarily - to behave in this way.

Sounds like excuses to me.

It's always a busy time for CFOs. These days there's very little downtime between deadlines and it can feel like crunch time all the time.

Lessons from an exceptional leader

I was reflecting recently on the best leaders I've worked for in my career. One of the stand-outs is an audit partner I worked for in San Francisco, Americas Leader for their Private Enterprise Practice, Conor Moore. Yes, as his name would suggest he's Irish and he carries with him that Irish charm that is simultaneously humble and hilarious, serious and self-deprecating.

In the name of quality and client service, it would have been very easy for Conor to adopt the 'work longer and harder' mindset. Having dinner brought in for 'the night shift' was common for audit teams back then as the Sarbanes-Oxley requirements were still relatively new and auditing standards and documentation requirements were increasing.

However, that wasn't Conor's nature. He wanted to get the job done, and enjoy doing it.

1. Let go vs micro-manage

The first thing that Conor enabled for me and the team was the freedom to complete the work in a way that worked for us.

For our team, in order to meet the SEC reporting deadlines we needed to work around the clock....but not 24 hours a day. So the team and I agreed they would do the work during the day and deliver me the binder (this was before we worked completely electronically) at 6 or 7pm for me to start my working day. I would spend the day at home doing the things I wanted to do, whether that be work out, do errands or simply relax. Then at night, it was 'game on' for me.

It might have seemed unthinkable to some partners that during the peak reporting seasons a Senior Manager wouldn't be working around the clock, but Conor believed that the team could organise itself around the tight deadlines. He was right.

2. Disrupted the chain of command

During my 2+ years on that particular client, the Concurring Review Partner (CRP) changed. If you're not familiar with it, the role of the CRP was to review the most critical and judgmental parts of the file to ensure the team had sufficient appropriate audit evidence to support the findings and conclusions it had made.

With a new partner came new questions and expectations...without any changing of reporting requirements or deadlines. In fact, it was about this time that it felt like reporting requirements got stricter and deadlines became tighter. Having invested the past few years making our process as schmick (and that's a technical term!) and friction-free as possible, something had to give.

Conor broke the process. 'Why don't we get everyone together on the first morning of the quarterly review – everyone from the CFO and audit CRP to the junior accountant and audit intern – and perform the analytical review together?', he suggested. 'We spend as much time as we need together to perform our required audit review procedures, clear any questions and queries that we have about the numbers, so that by the time we walk out of the room, the engagement is largely done, but for some documentation.'

This was genius. In making this suggestion, Conor:

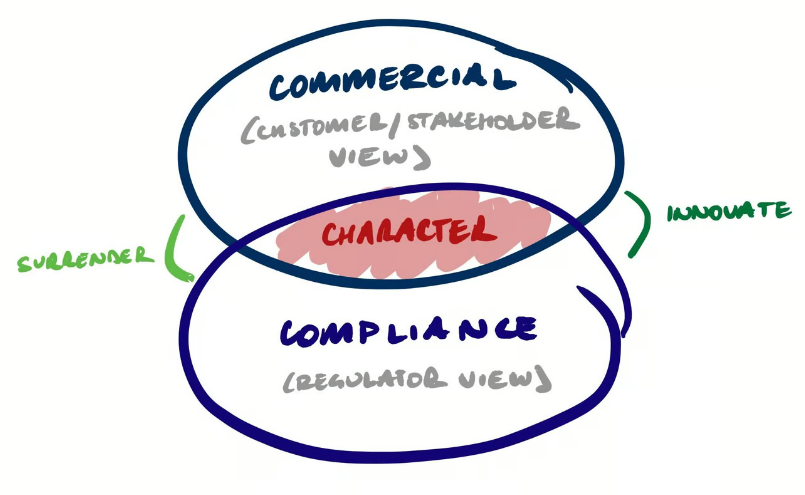

• Demonstrated his character and challenged convention. Not one for flexing his status or ego, he levelled the playing field by removing the hierarchy that is built into the both the audit review process and the finance team. In doing this, he elevated the responsibility and accountability for everyone to be present and bring their 'A-game' to that meeting. He also challenged the status quo and did things differently.

• Stayed true to his compliance responsibilities – it would have been tempting for him to influence the new concurring review partner to 'trust him' and to push the team harder to meet the crazy deadlines. But he didn't. He suggested a practical process that allowed each person to discharge their responsibilities fully, without compromise.

• Created a commercial solution – as I mentioned above, this audit client had extremely high standards which they held themselves and their service providers (including us) to account. Conor knew that as auditors we needed to step up to those standards and not be the factor that slowed things down. This new approach to our audits demonstrated our commitment to being commercial without compromising our compliance role.

Conor could have easily just kept us doing the way things had been done before, just working harder and faster, and through the night. His 'commercial' solution could have been to simply get his audit team working through the night so as not to disrupt or disturb the client all in the name of service. But he didn't.

He surrendered to the dogma that compliance and commercial responsibilities are mutually exclusive. By detaching from this perception he was able to consider what else might be possible in that pressure cooker scenario. And in doing so he innovated the generally accepted way of doing things. Not only that, he demonstrated his commitment to the team such that we would walk on water for him when the circumstance required it.

Consistency is critical

This is not an 'all roses' story. I cancelled trips to both Switzerland and Niagara Falls to meet other client deadlines that Conor and I worked together to meet. To this day I still have not taken those trips and they are 'the ones that got away'.

But do I begrudge Conor for that? Absolutely not. A great leader creates an environment that allows you to make empowered choices... even during crunch times.