This is why the four quadrants of CFO leadership is all around strategic leadership. As I state in my book, CFO of the Future, this quadrant is all about value. It's really about knowing that the business values the outcomes you deliver, and this is where commercial acumen sits at the absolute forefront.

Creating and adding value sits at the heart of a CFO's responsibility. You really need to focus on what value your organisation needs and to think strategically about how to deliver that. In order to deliver value to the business, you need an intimate understanding of what the business values.

Commercial acumen is about more than just numbers

So many CFOs never ask this basic question. They scurry down the 'finance improvement' and 'finance transformation' rabbit holes, never really knowing exactly what they're looking for. It's a waste of time, money, and resources.

At its core, the strategic leadership quadrant is all about commercial acumen and commercial conversations. Yes, you need to know about the latest innovations in technology, data, artificial intelligence, in order to be able to determine what is relevant to your organizations. Ultimately, however, you need to empower your business stakeholders with a level of financial literacy that allows them to make better business decisions for themselves. You need to communicate this in a way that is compelling and that makes sense to them. Ultimately, the value of the commercial acumen CFOs bring to the organisation is really about uniting your organisation in achieving high performance and driving commercial success.

A client recently shared with me about a comparison one of her Board members made, describing three types of CFOs using a boat as a metaphor.

Picture this: Some CFOs are at the stern, tallying up the catch—your classic Scorekeepers, focused on the numbers. Then there are those in the middle, toiling away, rowing hard—these are the CFOs in perpetual Firefighter or Delivery mode, often dubbed the 'Chief Fixing Officers.' And at the bow, you have CFOs scouting the horizon, seeking new ventures and dodging icebergs—the true Playmakers, guiding their organisation into the future.

A responsibility that must be earned by demonstrating to your CEO and Board that you can have both the commercial acumen to guide the future and the communication skills to influence the organisation.

For the organisations and CFOs that we work with, we have developed 'The Commercial Clarity Dashboard' to make sure that our CFOs are taking a commercial mindset to everything they do. We focus on a number of different metrics - the business KPIs, the financial metrics, the finance team priorities, the CFO performance goals, the finance team goals, right down to the individual sprints we create in the CFO boardroom together – and ensure that there is a clear link between all of them.

The 2 key questions we ask when developing the Commercial Clarity Dashboard are:

- What KPIs matter to the business?

- What drives the financial outcomes?

In the sales world, they would capture this thinking as a sales funnel. But for CFOs who need to consider both financial and non-financial metrics as well as past, present and future performance, we consider the following elements:

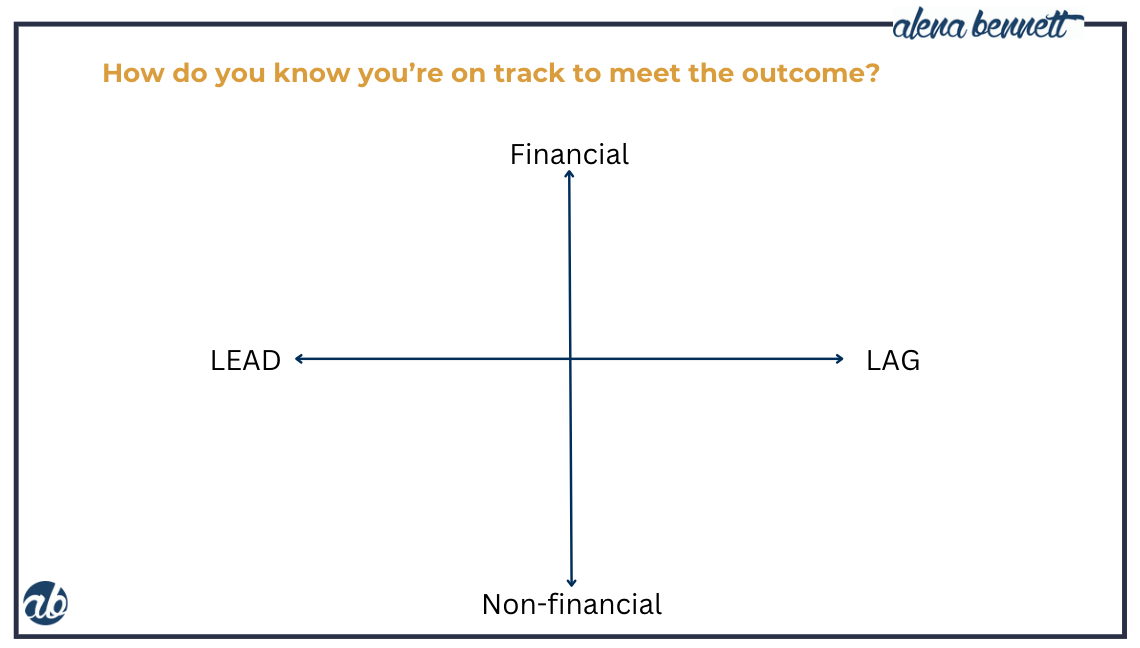

Are you leading or lagging?

I've written previously about how successful CFOs respond to this question, but in short a lead indicator is simply an indicator to help you understand whether you're going to hit your target or not. A lag indicator is typically the target itself and as well as other resulting consequences. In reality, lead and lag indicators follow a process timeline, which is why it sits as the X-axis below.

Whilst CFOs have a bias to financial metrics, the important thing that you want to remember is that those indicators may be financial or non-financial which is why the Y-axis is represented this way.

You might be now asking yourself the question, "How do I get this information if it's not already front of mind? How do I know what the key lead indicators that I should be focusing on that will give me a greater level of certainty that we will achieve the outcomes we need to?"

Here are 3 tips:

1. Spend time with the business: Where is your focus of

attention and energy? Is it with your team, or your stakeholders?

Take a top-down approach to everything you do.

2. Get out there: More and more, I'm hearing about CFOs

getting out and doing site visits, getting out on the floor,

spending more time on the floor and away from their desk.

Experiencing the process first hand so you can truly identify the

opportunities for you to add value.

3. Develop greater trust and empathy with your stakeholders. If

you want to not only sit at the bow, but speed up your boat,

invest in developing deeper level of trust and empathy with

your stakeholders. Do this, and they'll ask you onboard their

boat.

How CFOs use this approach to add value

The second question might be going through your head is, "How can you or your team use this information to create value for my business?" When you see all the indicators across the process and timeline, I encourage you to think about where you might be able to get yourself involved earlier in that process to add more value, increase the margin, and increase the probability of better return through your sales.

The 3 keys to getting commercial acumen "right"

Commercial acumen is a term often bandied around, but less often mastered. In order to do so, CFOs must focus on three critical elements: the levers of performance, the language of business, and the art of leverage.

Success hinges on a CFO's ability to track, understand, and communicate the vital performance drivers in a language that resonates with everyone in the organisation, avoiding financial jargon in favour of clear, impactful commercial terms that the business uses and understands. It's about translating complex financial concepts into strategic insights that inspire action. Finally, it's about leveraging the collective strength of their team to solidify the CFO's role as a dynamic, value-adding leader. The team's role is to amplify the CFO's vision, ensuring that their influence and insights permeate every aspect of the business.

Where could you get more involved?

Does your team serve as an amplifier?

Where are you on the boat?

Love to hear your thoughts...