In the evolving landscape of business today, the role of the Chief Financial Officer (CFO) has transformed significantly. Gone are the days when CFOs were merely guardians of the purse strings; today, they stand at the forefront of strategic growth, innovation, and organisational resilience.

However, a common frustration among CFOs is the feeling of underutilisation – or as we referred to it earlier this week in our Melbourne CFO Boardroom event — a sense that they haven't been given the opportunity to fully demonstrate the value they can add. This challenge stems from a fundamental disconnect: CEOs often limit their CFOs to roles and responsibilities within their realm of knowledge, which can be narrowly focused based on their own experiences.

This dynamic means CFOs need to be proactive and intentional, educating their CEOs about the broader spectrum of contributions they can make beyond traditional finance roles.

Building on the widely understood 4 stages of competence model, I've found CEOs can be characterised as follows with respect to how they optimise (or not) their CFO:

Level 2: Consciously incompetent: These CEOs typically have an elevated view of their own capability. This can come about because they have previously occupied the CFO seat, or perhaps they overestimate their capability due to significant subject matter expertise in the industry which they inadvertently extrapolate across all areas. They are quite intentional about their actions, but have a limited level of self-awareness and are usually busy, so inadvertently step on their CFOs toes. Quite often a consciously incompetent CEO will require the CFO to spend a lot of time and energy reining them in!

Level 3: Consciously competent: These CEOs know a little bit about 'what CFOs can do', but this is really informed by their own limited experience. Their CFOs can therefore feel kept 'in a box' which sits nicely in the CEO's comfort zone. For all finance matters, they actively give the CFO the lead to do the talking. These CEOs are ready to know what else you can do for them if you show them the way!

Level 4: Unconsciously competent: These CEOs defer to the CFO and only augment if useful. They're exceptional at staying 'on the balcony' and have the self-confidence and awareness that the focus is to support their team and further instil trust between the Board and Executive team. Because you already interact with your CEO in a very positive way, you are in a great position to influence them to take the next step to support you.

Level 5: Consciously cultivates: What makes these CEOs stand out is that they say 'I want your business strategy voice at the table: as a leader, not just as the CFO'. They are clear that the brand of a CFO is bigger and broader than it used to be, so they will proactively stretch you and your remit. These CFOs have a high level of emotional intelligence and also are highly accountable to expectations.

But how do you articulate to them what's possible for you?

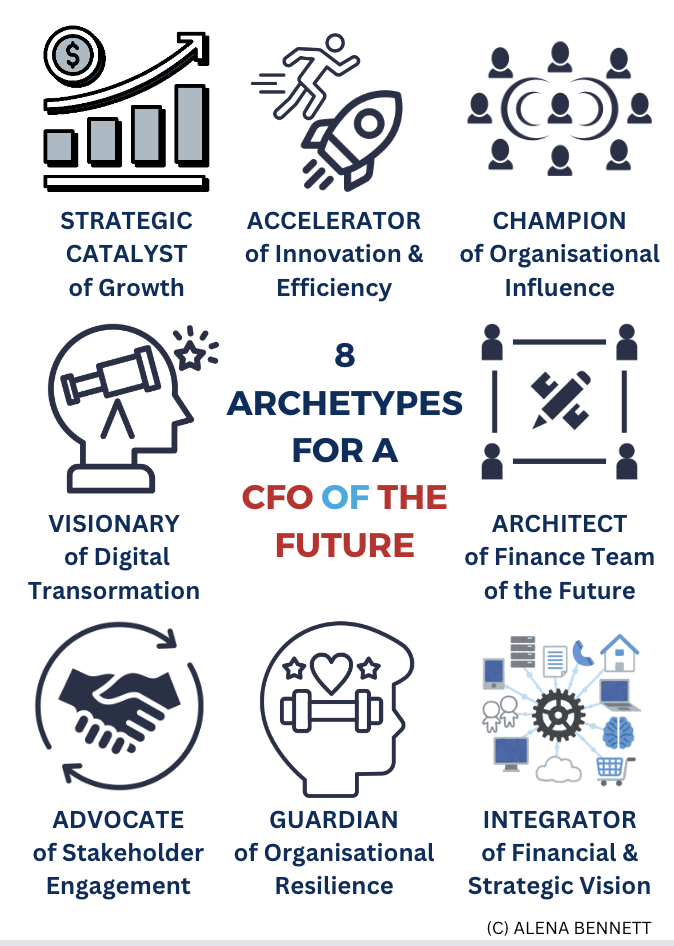

Below I've outlined eight archetypes that may help you describe to your CEO how they can harness your full capability – and even that of your team.

2. Accelerator of Innovation and Efficiency: They identify and implement technological advancements and process optimisations, fostering efficiency and agility

3. Champion of Organisational Influence: With a commanding presence, these CFOs drive organisational change and foster a culture of collaboration. We believe our value-driven CFOs truly deserve powerful executive presence, and elevating executive presence for the benefit of greater influence is one of the first 3 skills we address for our CFOs. This is why it's the first skill in the Change Leadership quadrant in the 4 Quadrants of CFO leadership model.

4. Architect of a Future-focused Team Culture: Focusing on talent development and high-performance culture, they prepare organisations to tackle future challenges. Our CFOs have a 'go first' mindset, and the investment they make in their teams often creates a ripple effect of elevated cultural maturity throughout their organisation. I'll describe for you how in my upcoming book, Finance Team of the Future!

5. Integrator of Financial and Strategic Vision: These CFOs ensure financial resources are allocated in a way that supports strategic ambitions, integrating financial planning with strategic goals. They show up to the Board and Executive table as the Voice of Value. Learn more about this in our 2024 CFO Annual Report to be released next week.

6. Guardian of Organisational Resilience: They play a crucial role in risk management, fortifying the organisation's defences against the internal and external forces that create uncertainty and volatility. A group of CFOs in our CFO Boardroom quipped that quite often they feel like the 'Chief Counselling Officer' in their organisation. This is telling....CFOs are 'people people'. If this is you, ask your CEO the question: what would be possible if our organisation and workforce were 20% more resilient?

7. Advocate for Stakeholder Engagement: By communicating with clarity and confidence, these CFOs strengthen relationships with stakeholders, enhancing trust and transparency. Financial translation in the Strategic Leadership/Value quadrant is critical here. You need to role model how to collaborate, educate and facilitate effectively across all business stakeholders in the pursuit of a common goal.

8. Visionary of Digital Transformation: Leading the charge in digital innovation, they empower organisations to make data-driven decisions and uncover new growth opportunities. This is a no-brainer for CFOs and comes with the imperative of creating a powerful partnership with the Chief Digital/ Technology Officer within your organisation.

In order to answer this question, it's important to recognise your current position and identifying the archetype that best aligns with both personal strengths and your organisation's needs to unlock new dimensions of value and impact.

This introspection and self-awareness is crucial for CFOs aiming to expand their influence and contribution beyond the confines of traditional financial management.

Whether it's steering through digital transformation, driving growth, or enhancing stakeholder engagement, aligning the CFO's role with the CEO's vision is fundamental to collective success.

The symbiotic relationship between CEOs and CFOs is instrumental in navigating the complexities of the modern business environment. By recognising and embracing the multifaceted roles CFOs can play, CEOs can unlock a treasure trove of strategic insight, operational excellence, and financial acumen.

You just need to show them what's possible.

How could you better showcase your strategic value to your CEO?

Which of these archetypes do you need to explore?

What would be most beneficial for your CEO?

Love to hear your thoughts..