• Discover how to view investability through the lens of the True Business Ecosystem™.

• Understand where and how CEOs and CFOs share accountability and responsibility for business performance.

Back in July, in my blog titled, If Buffett had $10 million, would he bet on your business? I talked about Warren Buffet's final letter to Berkshire Hathaway investors.

In it, he encouraged investors to look beyond GAAP earnings and judge company performance based on operating earnings. He argued that profit can easily be thrown out by accounting tricks, tax quirks and one-off gains.

The thing about profit is that it's a bit like my daughter's bedroom. It can look tidy from the doorway, but open the wardrobe and you'll find three months' worth of clean clothes shoved in there like some sort of textile avalanche.

Boards love profit because it is easy to measure and it gives them something concrete to point at in meetings.

But it's a lagging indicator. By the time problems show up in your profit line, you're already in trouble.

The Profit Trap

That's why Buffett ignores the GAAP headline. He knows that accounting profit can be manipulated.

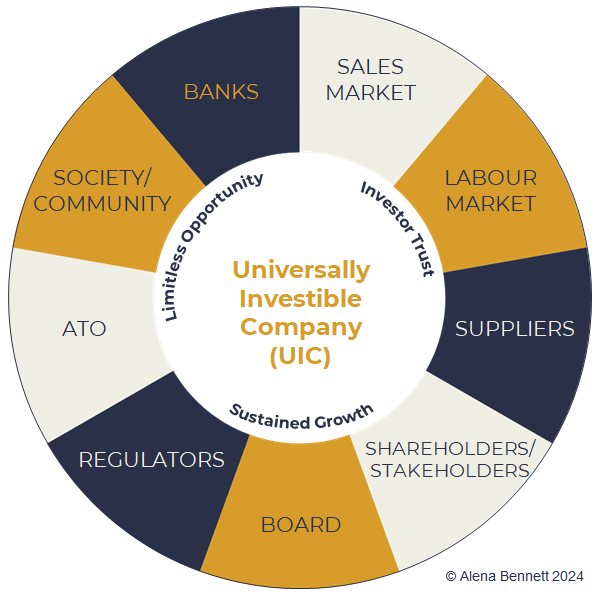

The real question isn't whether your company is profitable. It's whether it's investible. And not just as indicated by your share price, but as indicated by the health of your True Business Ecosystem™.

In a business that's irresistibly investible, every stakeholder in your True Business Ecosystem™ feels their investment is a ten out of ten decision.

You see it in behaviours:

• Investors raise their position whenever they have the opportunity.

• Partners bring you into deals based on reputation alone.

• Top talent calls you before you call them.

• Regulators have a good working relationship with your key personnel.

A business becomes irresistibly investible when all stakeholders believe their investment of time, money, energy or reputation is not just safe, but compounding.

And if they don't, you may be profitable in the short term, but you might just be in trouble in the long run.

The Courage Factor

The difficulty is obvious. Boards and owners lean hard on profit because it's what they can measure. The temptation for a CEO is to follow their lead and play it safe quarter by quarter.

But creating a truly investible company takes courage. Courage to accept short-term volatility in service of long-term positioning. Courage to tell your board: "Yes, this quarter is down, but this is the operating model that secures the next five years."

You don't need to find that courage on your own.

The Role of the CFO

In a Universally Investible Company™, the CEO is accountable for outcomes. The CFO is accountable for execution. The CEO has the freedom to create with the backing of a CFO enabler.

Not just because a great CFO can give the Board a view of multiple futures via clever, data-rich scenario planning, but because they're best placed to identify the strategic levers that, when pulled, lift confidence across the ecosystem.

They don't have to execute all the changes. But because everything shows up in the numbers eventually, they're uniquely equipped to drive alignment across functions and ensure nothing important gets ignored.

When a CEO has choices, they have confidence. The confidence to resist short-term pressure and commit to building something irresistible.

If irresistible investability is the goal, the CFO needs to be the first person to hear about it.

What Irresistible Investability Looks Like

An irresistibly investible business is one that:

An irresistibly investible company is built by design by a leadership team that chose to optimise for investability across their entire business ecosystem, rather than focus their attention solely on profit.

So my question to you is this: If your company were up for sale tomorrow, would buyers see a tidy house, or open the wardrobe and find the avalanche?

I'd love to hear your thoughts.