Most CFOs know how to cut costs and preserve cash. Fewer know how to create value while doing it.

One of my clients is a great example. Like most businesses, theirs hasn't been immune from current market headwinds. Conventional finance thinking would have had their CFO cut all spending and wait until conditions improved.

Instead, that CFO was sent overseas to a global trade show to explore the best equipment and services on offer.

They understood that timing is everything and used this period to strengthen customer relationships in smart, strategic ways, so when conditions improve, they're best in class in Australia.

It's easy to rely on faithful defensive tactics whenever there's a market contraction.

It's drilled into us from the first day on the job: when topline revenue is at risk, the finance team springs into action to cut costs, preserve cash and minimise risk.

These strategies aren't a bad thing in and of themselves. At the end of the day, the books need to balance.

But in the long term, defensive strategies used in isolation will devalue the business. None of them actually create value. They only buy time.

Because they know that the best time to build market share is when they step forward at the same time their competitors are stepping back.

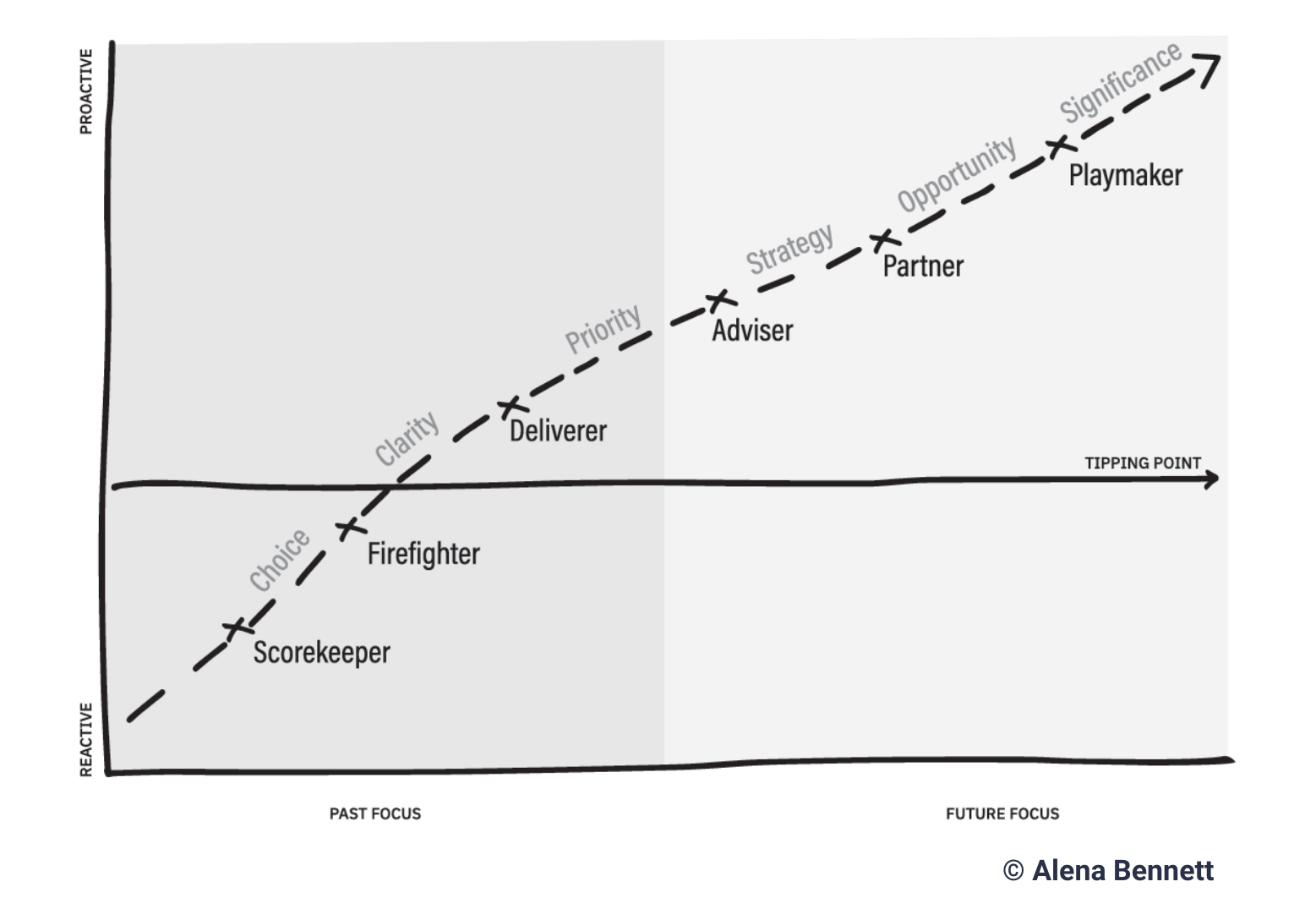

That's why we call our top-performing CFOs 'Playmakers'. Because they know how to create something out of seemingly nothing.

Playmakers know customers don't stop spending because they run out of money. They stop because they lose confidence. Investors do the same.

Great CFOs own the narrative. Great CFOs actively position the company as a safe, strategically sound opportunity, whatever the market conditions.

They know how to frame the data in a way that builds trust. They recognise that is more essential than ever to prioritise and nurture high-value customer relationships during a downturn.

You also understand that the most strategic time to deploy capital for talent, tech and assets is when your competition is pulling back on spend.

That's what my client did. They didn't wait. They backed their CFO with a mandate to invest, selectively, strategically, and with the long game in mind.

To lead well under pressure, you need to be in the right headspace.

If you're finding yourself withdrawing, spending less time with the CEO and your senior peers and more time with your team, it's a red flag that you are under pressure and you need to reach out for support. Not just for you, but for the business.

When you're not visible, you're not available to sell the business.

The CFOs who create value in a downturn are the ones clearheaded and energised enough to own the financial narrative, and sell the company's potential.

So take a look in the mirror.

What signals are you sending to your CEO and to the market right now?

And what do you need in order to show up at your best?

I'd love to hear your thoughts.