• Learn how Antifragile CFOs do things differently

• Unlock the 4 A's of Antifragility

• Discover how one airline leveraged chaos during Covid to double their revenue

In the first year of the Covid-19 pandemic, Qatar Airways lost more than $4 billion.

That's not a typo. Four. Billion.

Across the industry, airlines hemorrhaged money as thousands of planes were grounded in airports across the globe.

But not Qatar Airways. They outperformed the vast majority of their global counterparts, many of whom were forced to take out huge loans in order to avoid bankruptcy.

They stripped out seats, reconfigured routes, and turned their fleet into a cargo delivery powerhouse. Cargo revenue surged. Whilst their planes moved PPE, iPhones and microchips, senior management hit the boardroom and used the time to brainstorm new innovation.

Today, Qatar Airways has almost doubled its revenues vs 2019, has dramatically expanded the routes it flies, has created the world's first AI-powered digital human cabin crew and has just placed the single largest aircraft order in its history with Boeing.

Qatar's strategy was a masterclass in antifragility.

Last week, I wrote about what it means to be antifragile. It's a trait most CEOs say they want in their business.

This week, we're talking about how to build it. Starting with your CFO.

Because sooner or later, across the span of their decades-long careers, every senior leader will experience their Qatar moment. A market curveball, geopolitical shock or boardroom moment so humbling that they wish that the earth would open up and swallow them.

And when that moment hits, one of two things will happen: that senior leader will either fall back into defensive mode. Or they'll roll up their sleeves and look for the areas of opportunity.

This blog is for CEOs who want to ensure that their team, in particular their CFO, defaults to the latter.

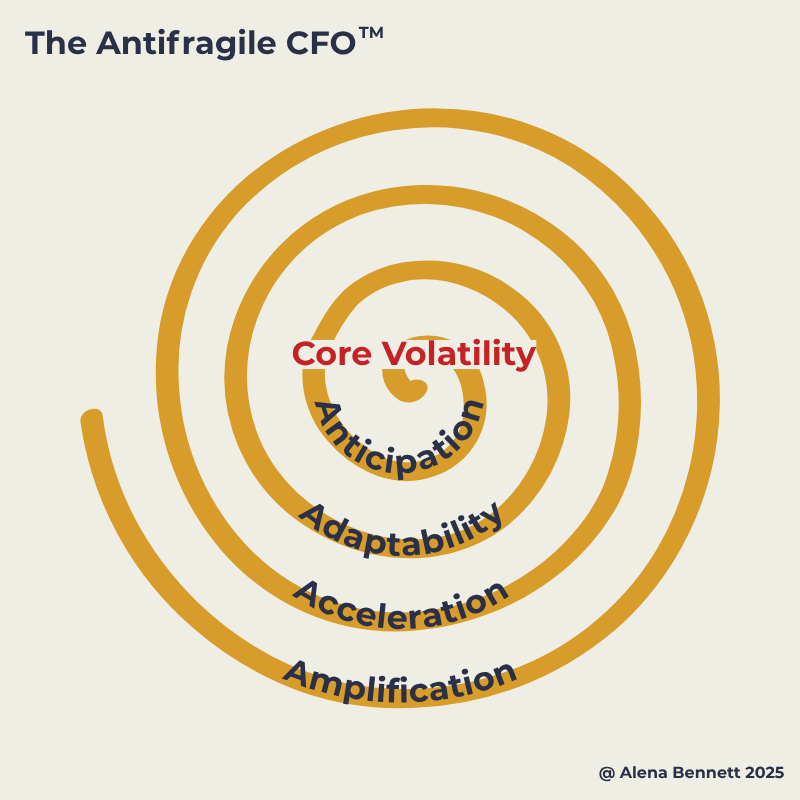

Introducing the Antifragile CFO Model™

I'm not denying that watching the financial news these days can feel like going to war.

However history shows that it's during times of chaos when the most opportunity presents itself.

This is exactly why I created the Antifragile CFO Model™.

Whilst a resilient CFO can keep the business steady and return the business to status quo after a market shock, an antifragile CFO looks for the opportunities to leverage volatility to deliver improved processes and performance.

They're uniquely placed to deliver. Your CFO holds the keys to the levers that make the most impact during periods of disruption: capital, risk, resources, and insight. They know where the cash is, where the risk lies, and where the business has the flexibility to take on new challenges.

They see the whole chessboard. When volatility hits, they're the one person in your organisation with both the visibility and the credibility to act at speed.

Here's the model.

At the centre is the thing that throws everyone off course. That's your pandemic, your regulatory change, your AI disruption.

Most businesses hunker down at the centre of this vortex to wait out the storm.

The Antifragile CFO turns to face outward.

Each loop out from the centre represents a decision, or an action that strengthens the business. Just like a cyclone spirals outward with force, each action taken during disruption expands the business's capacity. The more the CFO acts, the stronger the business gets.

The four As of the Antifragile CFO

1. Anticipation

Strategic Scenario Planning

An Antifragile CFO starts planning to take advantage of market volatility before it hits through proactive risk management and data-rich scenario planning. This means that when you walk into that first board meeting post-market shock, you already know your best-case, worst-case, and most-likely plan of action.

2. Adaptability

Agile Resource Allocation

Instead of pausing all spend "until things settle", an Antifragile CFO moves it to parts of the business that can make the best use of it.

Qatar Airways didn't suddenly become a cargo powerhouse overnight. Investment needed to be made in establishing new vendor relationships. And whilst they could have been forgiven for saving up that cargo fuelled cash reserve to tide them over until the end of the pandemic, instead they spent the money they might otherwise have spent on customer service on building the world's first AI-powered digital human cabin crew.

3. Acceleration

Faster, Smarter Decision-Making

The Antifragile CFO responds to external chaos by looking for ways to create internal calm. Internal staff movement means fresh eyes and new opportunities to eliminate bureaucratic friction, improve data reporting and create faster feedback loops. They work to ensure that the right people have the insights and the flexibility they need to act decisively, without the need to wait for "business as usual" to return.

4. Amplification

Stakeholder Confidence

While others are hiding behind press releases that give the impression of saying something, your CFO is speaking to investors, customers and the market. They communicate clearly how the business is practising antifragility and rather than trepidation, they create excitement amongst stakeholders. Most importantly, they give you the air cover you need to lead boldly.

In short: your CFO themselves becomes a strategic multiplier.

If another market shock were to happen tomorrow, how would your CFO respond?

Would they look for opportunities to strengthen the business or would they aim to maintain status quo?

I'd love to hear your thoughts.